PHOTO: ELISE AMENDOLA/ASSOCIATED PRESS

It’s time to make an obvious point… no one can consistently predict markets – wasn’t this supposed to the be the year retail died? Amazon dominates, but other retailers have figured out how to compete, how to sell, and how to grow in this ever changing retail environment.

Americans love to spend money and the overall consumer confidence is lifting many retailers’ stock prices to 52 week highs. The names are familiar, but the growing multi-channel and micro-retail trends have introduced new players to the top-returning stocks in the retailer space. New micro-retailers like SFIX (118% 1 yr return) and ETSY (200% 1 yr return) are booming and possibly changing the future of how we shop.

A not-all-inclusive look at retailers and their current price relative to 52 week high. $BBY is interesting with earnings right around the corner. pic.twitter.com/ow83ucdkdJ

— ЯYΛП 🦏 (@ryanmathews) August 18, 2018

It’s been a great run, but are there problems on the horizon?

The strength of the U.S. consumer economy worries me and the retail space will feel the hammer as soon as consumers get nervous and close their wallets. For now, we’re good, but Consumer Sentiment is showing signs of weakness that may or may not be tied to increasing interest rates and inflation. The ‘why’ doesn’t matter as much as the data, itself.

Let’s look at a few charts..

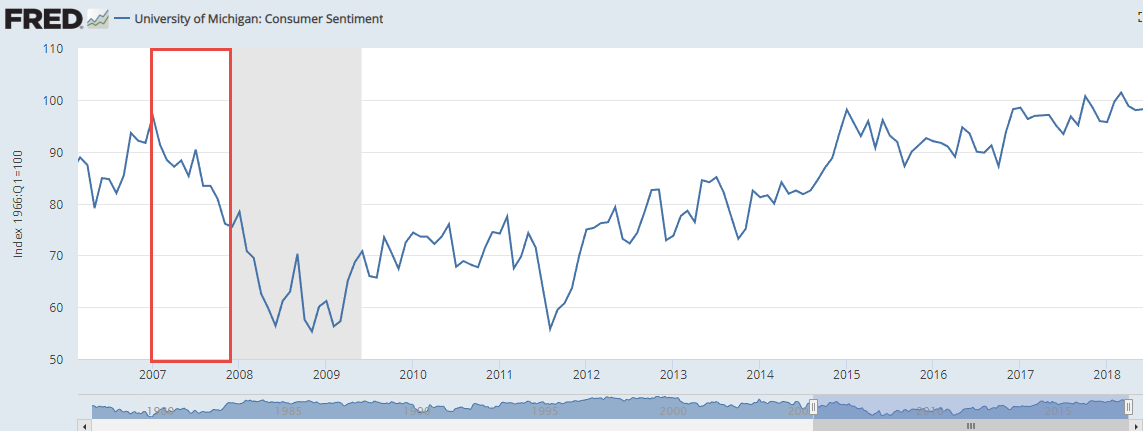

First, on the longer view, check out 2007 – the year before the big recession..

SPY weekly: Yellow square highlights 2007. It wasn’t a great year, but it also wasn’t a horrible year for the equities market.

SPY weekly 2007-2008

Now look at Consumer Sentiment. 2007 numbers trended down the entire year. Was it a tell? Maybe, but it was definitely a red flag for retail stocks.

Univ of Michigan: Consumer Sentiment

The chart below has the latest data. What do you see? Well, you see that we’re holding near highs, but 2018 is drifting down month after month (think 2007). Of course, sentiment is still over 90 (strong) so consumers are spending and living the life. However, the sentiment numbers show that some folks are starting to close their wallets, even if just a little.

source: tradingeconomics.com

I think the trend is obvious (until it’s not). It appears that the economy has topped. The benefits of the Trump’s tax plan have played out, inflation is knocking on the door, and interest rates are headed back up. Some of these indicators are normal in a strong environment. However, wages haven’t caught up, government spending is out of control, and healthcare/housing/education costs are sky-rocking with no improvements in site. This doesn’t even factor in trade-war concerns.

It’s time to cycle back down. However, until retailers start showing concern, we’ll likely continue to see strength and stocks will print new 52 week highs. If that Consumer Sentiment starts drifting below 90, all bets are off.

In the near term, BBY looks interesting (reports on the 10th). They’ve done a good job evolving their ecommerce and support strategies, so I expect them to have a good report (no position).

Best Buy (BBY) Weekly