Bust out your flags, hot dogs, and favorite American beer. It’s 4th of July and all is good…. kinda.

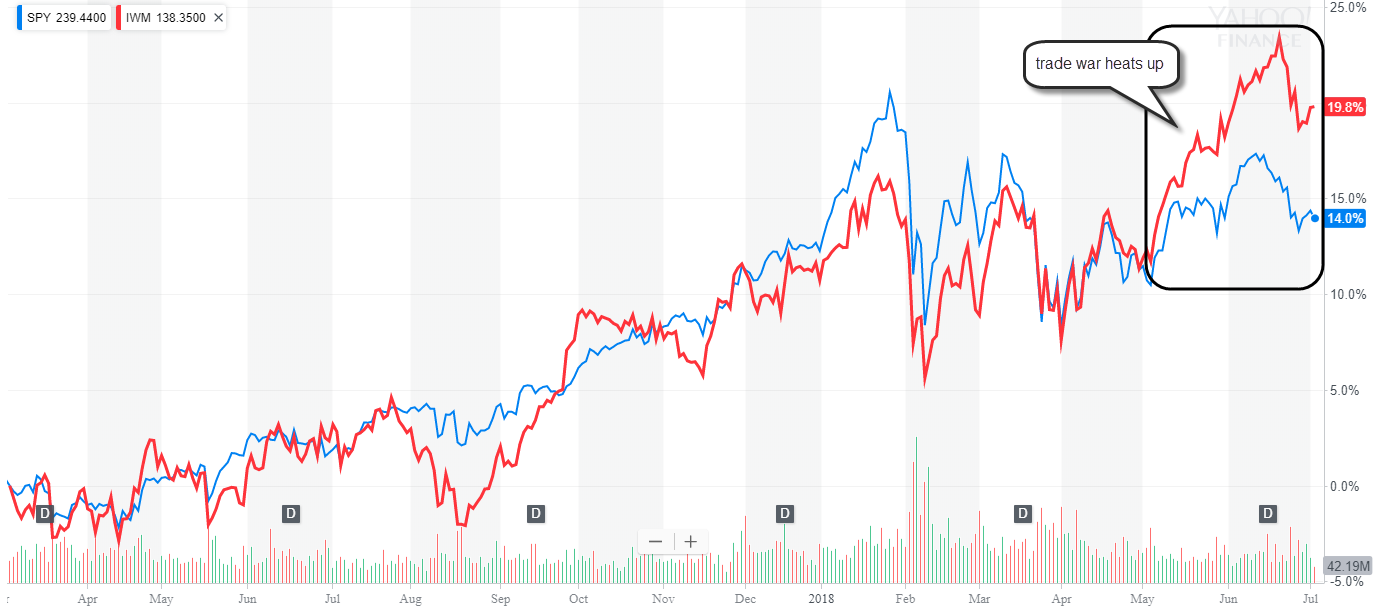

The market is still showing signs of weakness, especially the large cap equities stocks. This group usually has more international exposure and is currently under pressure from Trump’s unnecessary trade war. The war doesn’t have to make economic sense. It just has to appease Trump’s base who feels disenfranchised and victims of globalization and disproportionate distribution of wealth.

I’m still generally bearish right now and Tuesday’s half-day action was pretty ugly. As I mentioned a few weeks back, it feels like the high of the year is in. I really hope I’m wrong, but there are too many headwinds right now to feel confident that the market has much upside in the near-to-six-month time frame.

First time I’ve felt a little uneasy about my long positions into the weekend. Still feel like the year’s high is almost in for the equities market. Hope I’m wrong. I tend to learn more when I’m misreading the world around me.

— ЯYΛП 🦏 (@ryanmathews) June 16, 2018

Position Updates

I have numerous accounts from CDs and savings to short and long-term brokerage. They are built on different risk levels, time frames, and goals, so the shifts in investments don’t always apply to all accounts at the same time. Here are a few themes/moves I’ve implemented over the last few weeks..

- Added to dividend paying stocks

- Increased cash

- Bought CDs and increased cash in high-interest savings account.

- Shifted some of the equity exposure from high PE ‘cloud’ stocks to consumer non-cyclicals

- Tightened stops on equites

- Focused more on small-cap, domestic stocks