As I get older, removing stress has become an increasingly important aspect of my daily life. Hell, I’m even considering adding a koi pond in the back yard.

Over the last few weeks, the market volatility and the day-to-day swings have been causing me some angst – I don’t like it. My natural response is to move to cash and stay out of the way. That’s where I am today – building up cash in a shaky world. I know this, too, shall pass and I’ll put my cash to work (cash is a bad thing to have for extended periods of time).

My current cash allocation by account:

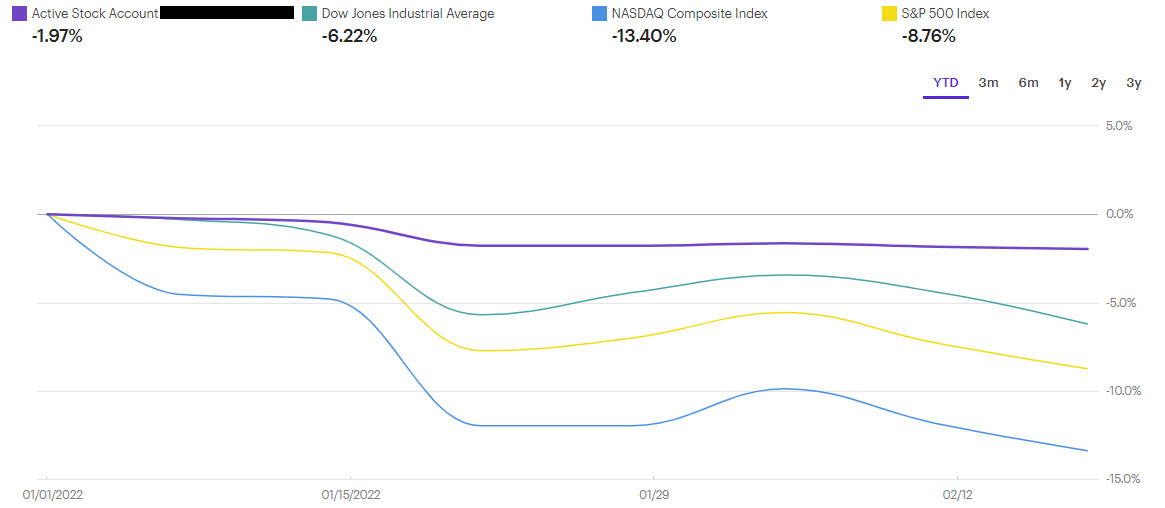

401k: 100% cash as of last Wednesday (Feb 16th). Although I don’t recommend trying to time the market, my YTD P/L% (-4%) is better than the major indices.

Robinhood Brokerage (high risk equities trading): 90% cash. I’m down 7% YTD in this account. The few positions I have will likely bleed before going back up, but I’m not overly concerned since the exposure is minimal.

M1Finance (Dividend income account): 0% cash. P/L% YTD (-4%). My focus is to build up positions over time in quality dividend investments. I do not stress about short term moves in the underlying equity.

eTrade Brokerage (Growth oriented, swing trading): 83% cash. Like my 401k, I’m pleased with my YTD P/L% (-2%)

Etrade IRA: 10% cash. YTD P/L% also beating the overall market (-3.78%).

Webull (High risk plus some ETFs): 15% cash. I’ve made some unfortunate trading mistakes here and am getting punished for it. Luckily, Webull represents a small percentage of my portfolio, so I’m not going to sweat it. YTD P/L% (-10.5%).

So, what’s next?

First things, first. As soon as the conflict in Ukraine starts to deescalate, I’ll start to slowly move back into long positions.

Then there is inflation and rate hikes. I believe the anticipated rate hikes in 2022 are largely baked in. However, I’m not convinced that the market has priced in a significant slowdown in consumer spending. Wage inflation is real and consumers are still spending money, but I think the slowdown will hit hard and surprise a lot of people. This may be just enough to slide us into a recession.

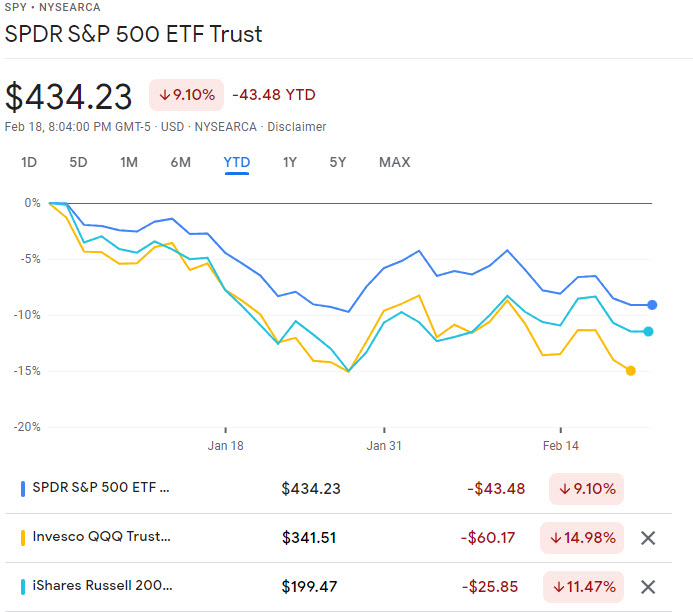

Outside of that, I’m watching the MA300 on SPY daily. The chart is setting up for bullish reversal, but there are so many macro factors that could destroy technical analysis over the next 2-3 months. I really need to see SPY get above sma200 and strength in the QQQ before I put cash to work.