We all know the story…

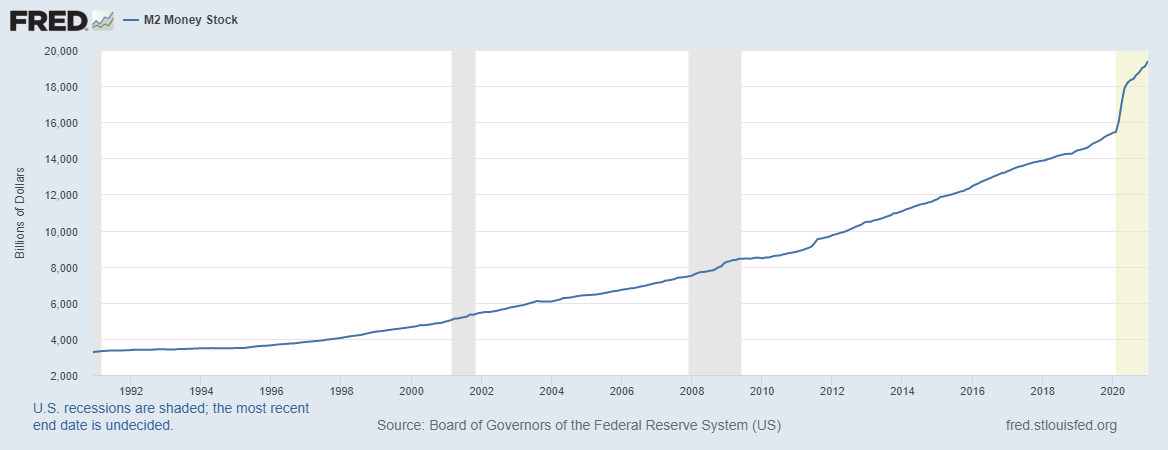

- Money is being printed at staggering levels, flooding the market with liquidity.

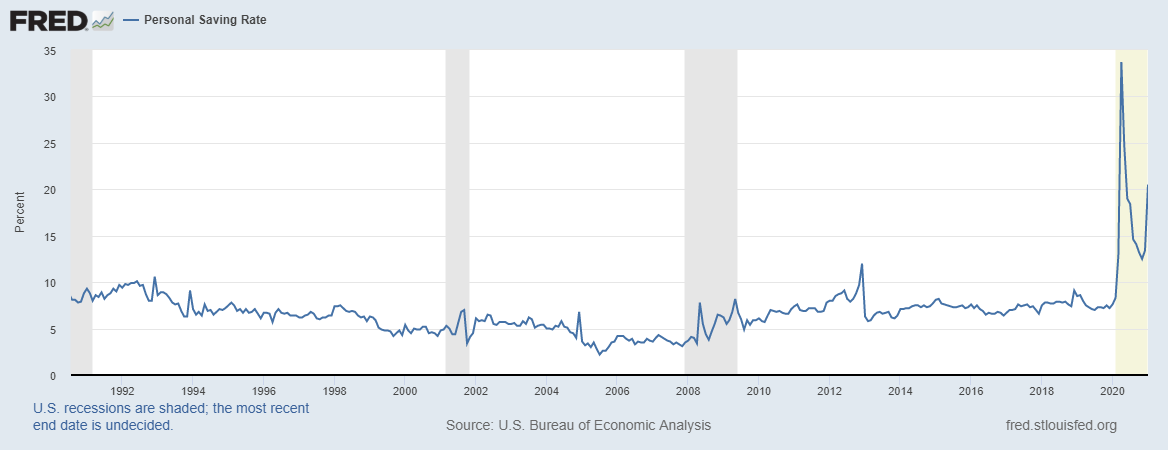

- Personal Savings is up

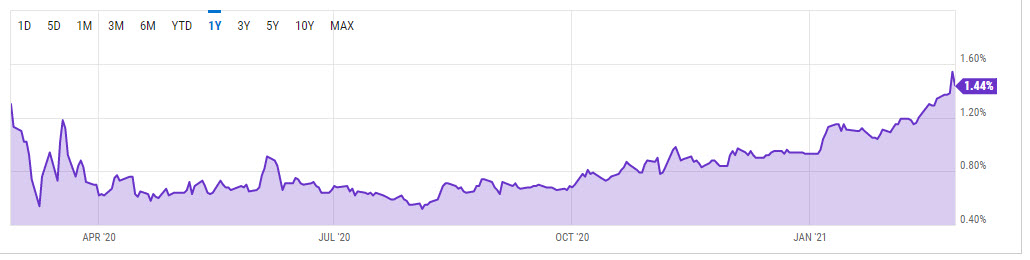

- Bond yields are up

- Covid vaccines are being put into arms at increasingly high rates

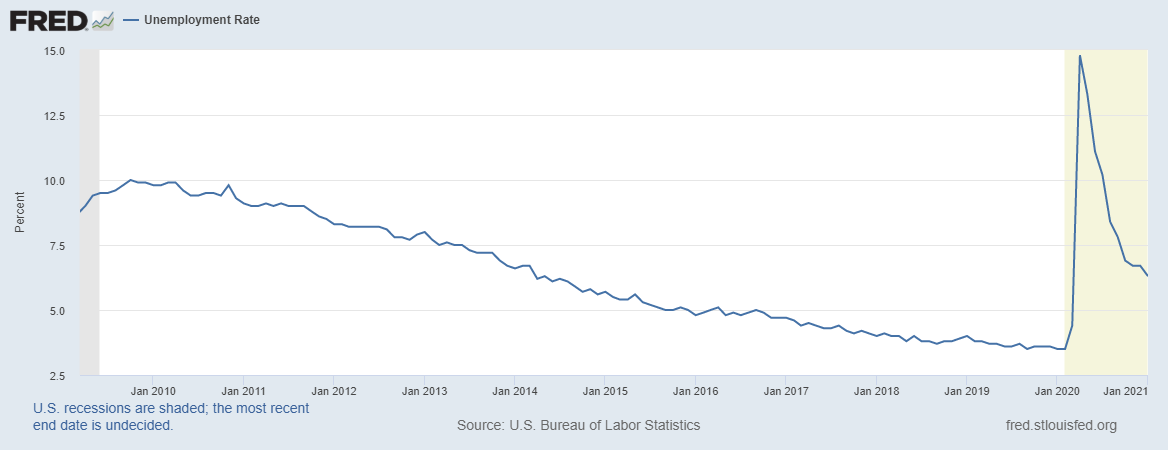

- Unemployment rates remain high compared to the pre-covid environment.

Do you see the problem with this data? Printing money and low interest rates should increase spending and monetary circulation. However, savings rates are up and the desired effect is muted. The money is still out there, just a very large portion of it on the sidelines thanks to Covid-19. But, is that all about to quickly change? That’s the concern.

A faster than expected move of money into the economy and out of savings could be very inflationary. The bond market thinks this is about to happen. Bonds become less attractive in an inflationary world, so yields are forced higher to compete against other assets that may beat the rate of inflation. The bond yields have been steadily rising over the last month and suddenly everyone is talking about inflation and jumping out of growth stocks. There is lot of debate around which economic indicator really matters and if the equities market should go up or down. Inflation may limit growth in equity markets as bond yields become more attractive and business costs increase. However, inflation also implies higher spending which should be good for companies, yes? It’s a confusing mess.

The biggest fear is less about bond yields, but the story yields are trying to tell about future interest rates and consumer spending power. Powell keeps pounding the table that interest rates will not go up anytime soon and a little inflation is ok… the market doesn’t believe him as indicated by last week’s stock market sell-off. Powell says that employment is the most important influence on FED policies and the unemployment numbers are still high. Even if interest rates stay low, at minimum, it looks like the market is trying to reset and remove some of the hyper-speculative environment we’ve seen over the last year. What last week’s equity market also reminds us is that the equity market is fragile and the bull ride may end quickly and painfully for many.

So where are we and what do I do now?

My take is that it’s time to sell losers, minimize holdings, and hyper focus on quality. I’m looking for good companies going on sale for discounted prices. Of course, my portfolio may lose value while shopping for quality. That has to be expected. In addition to selling the crap and buying quality on pullbacks, I’m going to raise cash. This applies to my 401k (shifted to 50% cash last week) as well as my various trading accounts. I need to see this Friday’s Non-Farm Payroll numbers before even considering going heavy in equities.

I will still participate in speculative trades like SPACs and momentum/meme stocks, but these will represent a smaller percentage of my overnight holdings.

A few quick points on earnings this week:

$SPY $QQQ #Earnings $NIO Monday after the bell https://t.co/LkW1RZnEqc pic.twitter.com/nPxdRx0O1K

— ZoZoTrader (@ZoZoStockwatch) February 27, 2021

Monday – watching NIO and WKHS. I can’t figure out the story here, so I’m not involved, but curious. ZM will likely fade earnings. LMND is very interesting and I may pick up some ahead of numbers.

Tuesday – I like TGT and SE long-term. VEEV interesting on pullback. FUBO too speculative for me in this environment, for now.

Wednesday – AEO is one of my favorite apparel stocks. I want more, just haven’t decided on an entry target. SNOW I may like lower along with OKTA and DLTR.

Thursday – KR just feels like dead-man walking. I’m not interested. I like PRPL and maybe COST

Friday – NON-FARM PAYROLLS!

Have a great week and trade ’em well.