The equities market is experiencing obvious signs of self reflection and rotation (hello energy). This increases the odds of a significant pullback across the board, but volume hasn’t played that scenario out quite yet. In the absence of a pullback, we often experience a strengthening in ‘safety’ trades like high dividend paying stocks and utility stocks (hello regulated utilities).

For now, I’m not stressing about the rotation out of tech – there are a LOT of good looking setups. Regarding tech stocks, I do feel that it’s bearish for the overall market if the tech leaders (FAANG) start falling through support. Traders will likely freak if that’s the case.

Watch List (it’s a big one)

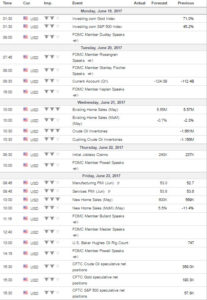

[/iconbox][iconbox type=”3″ icon=”zo-calendar” title=”This Week’s Economic Calendar (U.S.)”] [/iconbox]Few Big Picture Charts

For SPY,I’m watching the pullback to horizontal support ~240.54. But, it’s very difficult to know where SPY is headed right now and for most of my trades, it makes more sense to focus on individual stocks and sectors.

As much as I don’t understand it, XLE looks pretty good and more specifically, many oil and gas stocks finished strong on Friday.

Stocks making the watch list

I have a ton of stocks on my watch list, but here are my favorite charts worth watching headed into Monday:

XRAY – watching that horizontal resistance

AVEO trying to come out of a symmetrical triangle with strong Friday volume.

OKE – energy play… there are a lot of charts that look just like OKE.

VRAY not doing a lot yet, but watching for test of sma50 (red line)