Ugh. My day job has been overwhelming my life lately and keeping me from posting. Why, you ask? I work for a large IT company and it’s Black Friday season. We sell a crap load of stuff this time of year and I’m significantly involved in the online efforts to make it all happen. Having said that, let’s take a look at what’s happening in my M1 passive income account.

Summary

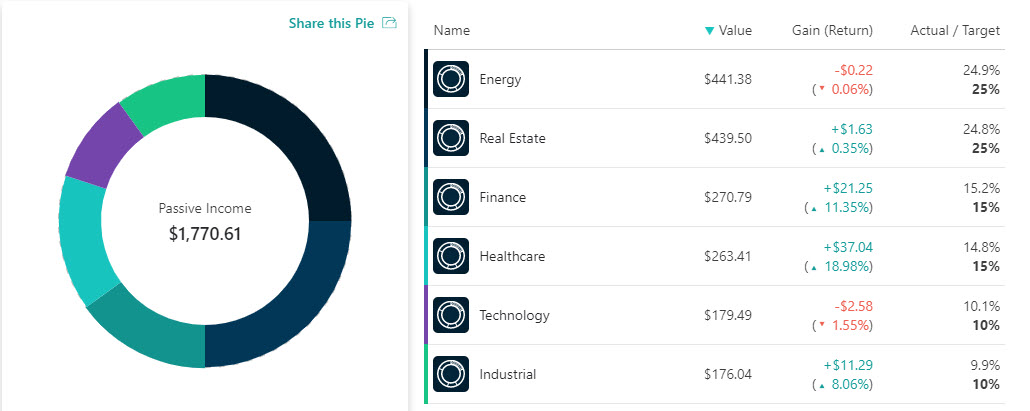

- Currently up 6.43% (since mid September)

- Gains have pulled back slightly over the last month thanks to weakness in O

- No recent additions to portfolio, but I’m depositing funds weekly.

Current positions and observations

Energy (25%)

HASI – Price has pulled back to technical support. Dividend Yield at 4.69% quarterly, but a slightly high payout ratio of 96.46%. I’m holding for now.

XOM – Price is choppy, but I feel that adding long in the 60s was a good move. Dividend Yield at 5.02% with 37 years of dividend growth.

Real Estate (25%)

O – Price has pulled back, but I have no interest in selling. Dividend Yield at 3.57% with 25 years of dividend growth.

STOR – Still running strong and I love the sector. Dividend Yield at 3.49% and a 3% payout ratio.

Finance (15%)

OZK – Banks have been strong over the last few months. Dividend Yield at 3.16% with 21 years of dividend growth and a low payout ratio of 28%. Nice.

Healthcare (15%)

ABBV – After a major run, ABBV pulled back over the last week, but still up huge since my entry at $74. Dividend Yield at 5.49%.

CAH – No complaints here. Dividend Yield at 3.46% with 23 years of dividend growth.

Technology (10%)

IBM – It’s hated, so I’m interested. Price hasn’t moved much lately, but the Dividend Yield of 4.82% is strong… and the 20 years of dividend growth.

Industrial (10%)

HON – Not much to report here. Dividend is a little low, but reliable.

One Comment