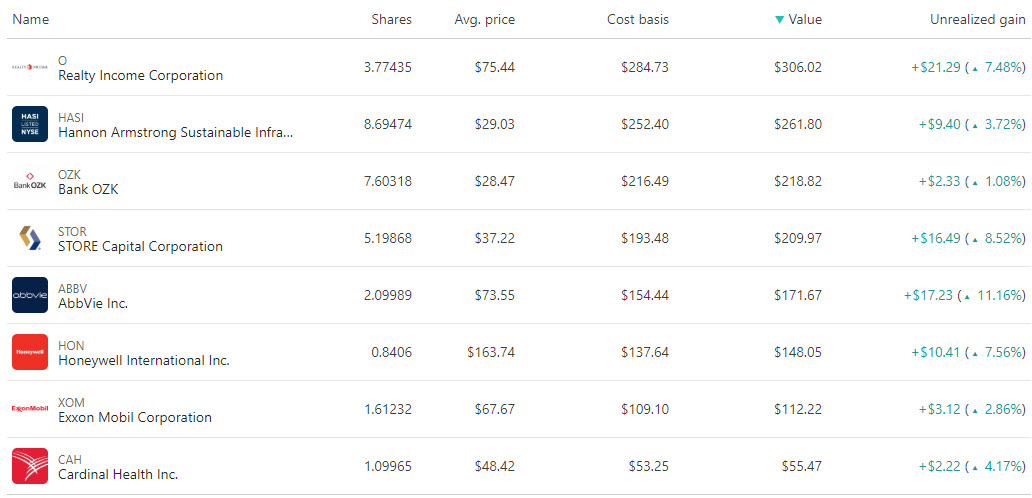

My M1 account is growing nicely with names like ABBV showing real equity strength last week.

A few notes:

- Although OZK‘s stock hasn’t performed too well, the dividend is strong (over 3%) with 21 years of growth. I’ll probably add some additional banking exposure over the next few week.

- ABBV is rocking as value investors pile in on strong earnings and low PE. ABBV also announced it was increasing its 2020 dividend to $1.18 per share from $1.07 per share (+10%).

- O has had a very strong year, but I expect a pullback soon (maybe this week’s earnings). It may offer an good opportunity to add more at a lower entry.

- HASI is still trending up on a dividend of over 4%. Earnings looked good last week, as well.

- STOR hit a 52 week high last week. No reason to sell this position.

- HON was a recent addition to my portfolio and has enjoyed an end of October move in industrials.

- Not much to report with XOM.

- CAH reports next week, so this could change my opinion. For now, I’m good.

Positions (account opened Sept 13, ’19):

A new addition:

Although this may not seem logical, I added IBM on Friday (will adjust overall M1 position allocation on Monday). I decided to step in after the recent earnings drop to account for any near-term discounts we’ll likely see. The daily chart below shows an obvious trendline support level that I expect IBM to hold assuming overall market maintains strength.

IBM Daily

One Comment