Every two to three weeks, I take a hard look at my Roth IRA positions to identify weaknesses and opportunities. You gotta stay up on this stuff and adjust to market conditions. Of course, life got easier when eTrade implemented zero commission trades.

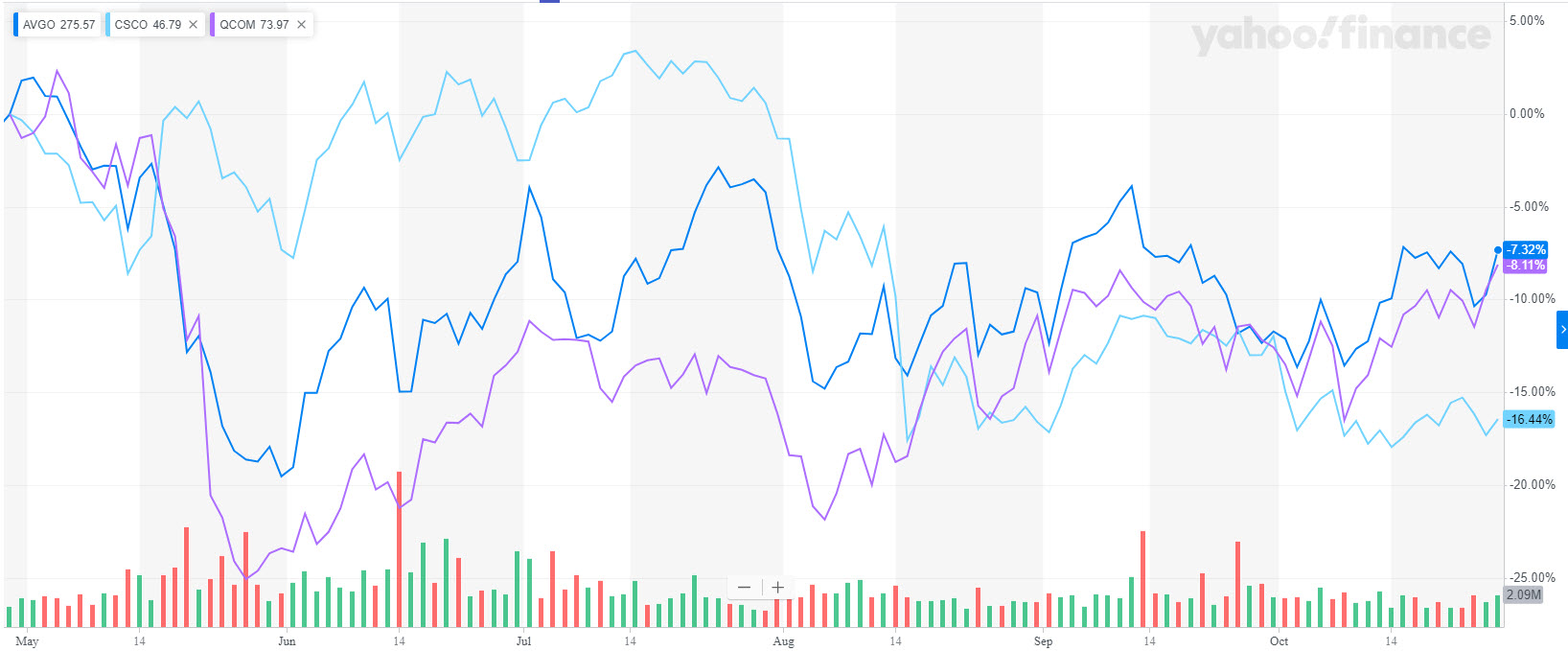

The first thing that jumps out to me is that I might be too exposed to tech. I’m not selling Microsoft – let’s clear that up. So, the three I’m concerned about are CSCO, AVGO, and QCOM. Is there too overlap and do I need all three in my portfolio? Let’s do some comparisons.

AVGO is a hardware company with primary focus on infrastructure and semiconductor products. There is a little 5G play in here.

CSCO is another hardware company, but focuses more on network and telecommunications equipment.

QCOM is another semi stock (chip maker) with some 5g exposure.

Obviously, there is some overlap. Now lets compare the charts…

As you can see, AVGO and QCOM have very similar charts… maybe too similar to own both.

Ok. How about dividends? We are talking about a retirement account, so dividends matter.

The dividend comparison doesn’t show an obvious winner. QCOM‘s payout is a touch lower, but has 16 years of dividends growth.

So, what do I do? I do think there is too much overlap and I want to remove either QCOM or AVGO from my Roth portfolio. However, as of TODAY, they both have good stock charts. I want to take advantage of this, so I’ll hold both for now, but look to sell whichever one starts to weaken relative to the other. For now, it’s a hold.

Moving on…

3M. Ugh. This stock has been a mess and its report last week was ugly. I own MMM at a pretty low price, so it hasn’t hurt me too much and I love the 3.47% dividend yield with a 60 year dividend growth. I may just leave it alone and grow the position at lower prices. The relative stability is attractive for the long-term.

ELS has been a beast. That chart has been unbelievable and has really benefited from our aging population. I play this stock more on the price activity than the value of its dividend, so I’ll continue to watch the daily chart and set stops. Although the dividend has been low, it has a 14 year growth rate. Nice.

WMT pays year after year. No need to sell, for now..

RY pays a 3.78% dividend with a low 24% payout ratio. Banks have not had a lot of love, but I’ll continue to hold for the yield. I may shift to JPM on next bank pullback. It’s a lower yield, but a best of breed company.

JNJ has really disappointed thanks to all of the lawsuits and the negative news that relentlessly pounds on the stock price. On the flip side, it has a 57 year payout and prices are very low.. maybe a time to add more?

MRK, VOO, and PG – No changes her.

TYG is my one high-risk dividend play. Stock price sucks and I don’t care – I’ll stick with it for the 13% dividend yield. Not the smartest trade in the account, but a very small percentage of portfolio.

So, that’s all for now. My only upcoming actions will be to watch QCOM and AVGO and determine which one to stick with. I may also move out of RY if the timing is right.

From a new positions stand point, I’ll visit this more in November, but gold and a few REITs are interesting. More to come on this next month.

One Comment