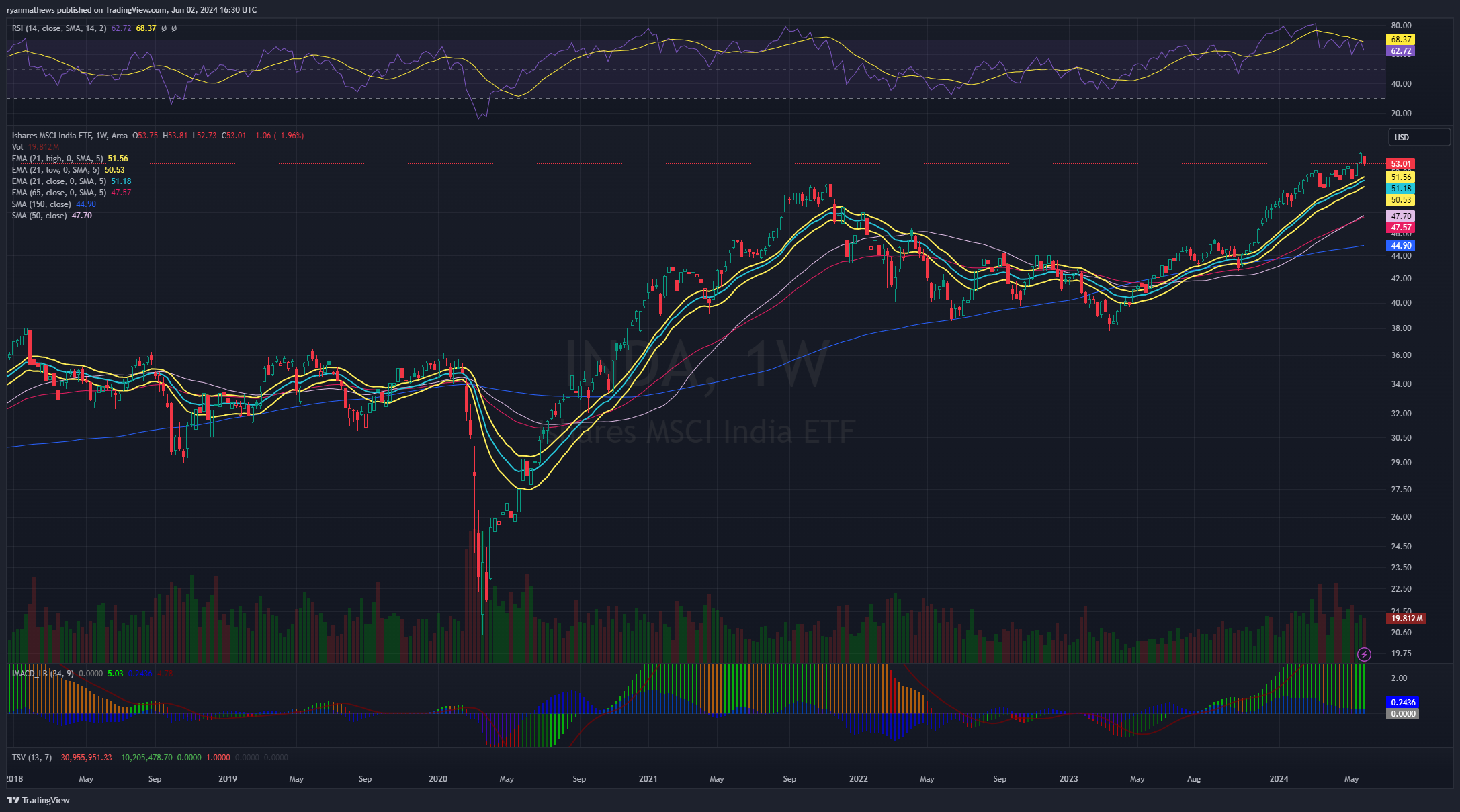

6/4/2024 Update: Election results in India have really shaken up their markets this morning. Although I still want to buy into INDA, I want to see where the price settles out.

I’m late with this post, but it’s better late than never to talk about India and its undeniable growth. I’ve always been a U.S. centric investor and probably always will. However, my neighbor is from India and many of the teams I work with throughout the week live in India. The message from all of them is clear and aligned – although India has a long and bumpy road ahead, their economy is growing and a rising number of citizens are improving their economic status and purchasing power.

A recent article from Goldman Sachs identifies three takeaways that make India an attractive investment opportunity:

- Growth Momentum

India continues to outperform major economies. Its strong growth story is underpinned by reform efforts across sectors, favorable demographics, and supply chain shifts. - Investment Appeal

Increasing digitization and maturing capital markets, supported by technical tailwinds like global bond index inclusion, are strengthening its appeal as an investment destination.

- Opportunity Amid Complexity

Investors should be selective and use on-the-ground expertise to navigate India’s complexity, including an upcoming general election, and rapid economic and societal change.

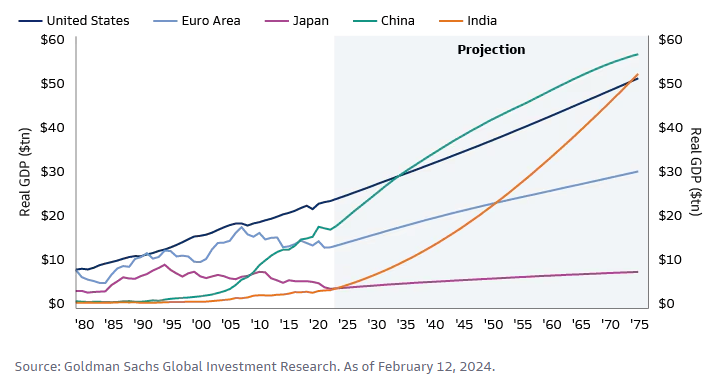

As you can see from the chart below, India’s economy is on a strong, upwards trajectory after many decades of minimal growth.

Is now the time to take on some India exposure in my investment portfolio? I believe so. The easiest way to do this is through a broad ETF. The most traded ETF is INDA. The expense ratio is a little high (.65%), but INDA is still probably the best way to dip your toe into India equity markets.

From iShares:

- Exposure to Indian equities: Gain exposure to large- and mid-capitalization companies in India.

- Targeted access: Seek to express a granular view on Indian stocks and growth of a major developing economy.

- Complement your portfolio: Use to customize your emerging market exposures with a targeted exposure to India.

A look at the weekly chart shows that INDA has had a strong run over the last year – really wish I had picked it up in 2023, but oh, well. However, I’ll likely add a small position as soon as this week and see where it goes from there. This will not be a trade, but instead a long-term buy and hold.

India Weekly Chart

NOTE: For informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services.