The recent strength is the equities market makes sense, but I don’t think this translates into a long-term move. More likely, this is a desperately needed bear market rally and an opportunity to take advantage of FOMO. And, even though I think we’ll give back a lot of these recent gains, I did mange to put long-side money to work in beaten down tech names and market ETFs. Of course, I could be wrong and the market bottom is in, but I think we need the create a new base to build upon before we go much higher. In other words, a flat market for a week or two would be ideal, although not likely.

The good news…

Inflation continues to retreat and last Thursday’s print was lower than expected. This drove equities up, reflecting optimism that inflation may cool quicker than anticipated.

Inflation Rate

Russia retreats from areas of Ukraine. I have no idea where this war is going, but there is more pressure from the U.S. and other countries to wind down. The market prefers certainty and creating some clarity would take some weight off the investment community and hopefully open back up commodity roadblocks.

The confusing data…

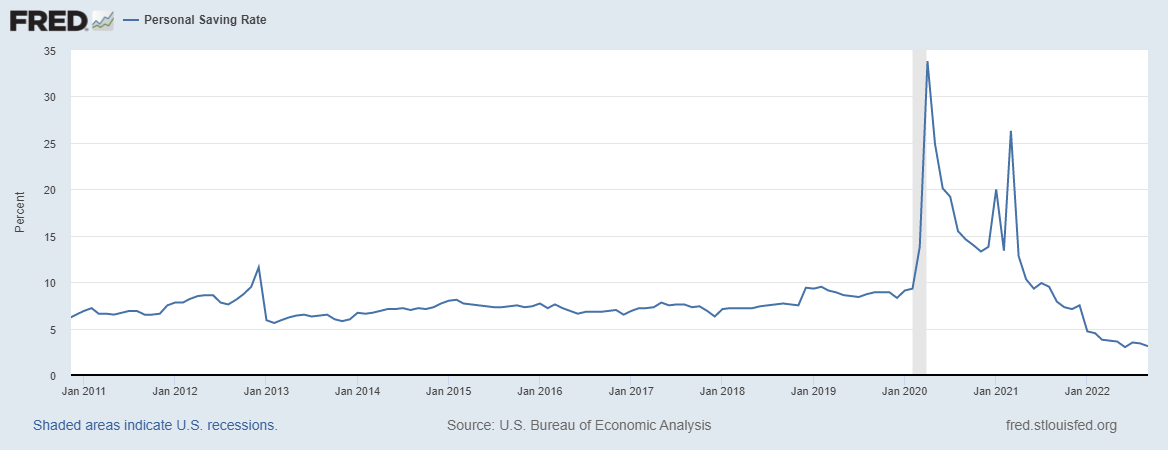

There are a lot of consumer related reports that are much stronger than I would expect them to be in a highly inflationary world. However, inflation is up after a two year period of everyone being trapped at home, accumulating cash. The consumer has had enough and continue to spend, despite these concerns. Yes, they are worried about inflation, but still spending and no longer feel the pressure to save – normally a bullish sign.

Unemployment also remains strong. This is a best case scenario – Inflation moves down on Fed interest rate hikes while at the same time not damaging employment.

This is not expected, but here we are. Until this number and savings rates start bumping up, it’s worth staying optimistic and at least dabbling in long term trades. For investment strategies 3+ years out, this may be the best time to add long since there will be time to absorb more downside before equities ultimately move to new highs. Only time will tell.

In the near term, I’ll likely take some profits as SPY approaches SMA200 on the daily chart. The QQQs show more technical upside, but the move across most equities has been very strong and abrupt. Starting Monday, I’ll evaluate all of my holdings and start setting stops. If I finish the end of the week with few holdings in my trading accounts, I will consider it a great few weeks and time to consider the next move and opportunities.

Current net value growth YTD: -3.6%

Trade ’em well!