Inflation is still out of control. China is struggling with to properly handle Covid, Taiwan, and Russia. Supply chain issues persist. War. Commodity prices. General unhappiness and division in the states. It all sucks and likely to get much worse before it gets better.

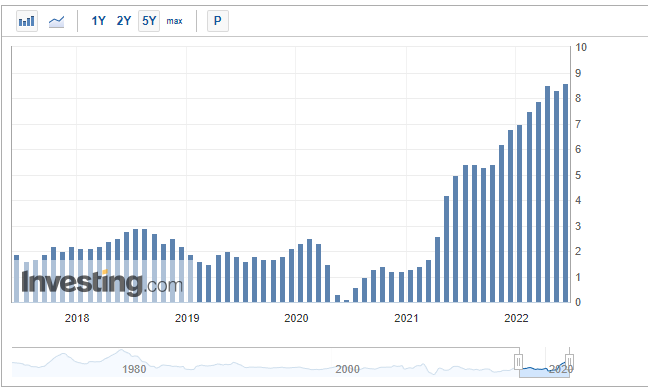

This is a nasty chart and will require some major FED intervention. Until demand starts significantly falling, inflation will continue to cause real problems for the economy and your net worth. The FED is about to put down the hammer and force a recession… Quantitative Tightening and rising interest rates are no joke and no one can avoid the fallout.

CPI

Headed into this week, my mindset hasn’t changed too much. The general consensus is that the market is rolling over, so it is until it isn’t. I’ll likely sell what few positions I have on any up days and watch for very limited opportunities. My favorite sectors include energy, commodities (wheat, agriculture), some consumer staples, and REITs paying divs.

I do not like housing, autos, airlines, and consumer discretionaries.

Check out this WEAT chart. Interesting long.

Trade ’em well.