The market is starting to spook me a little.

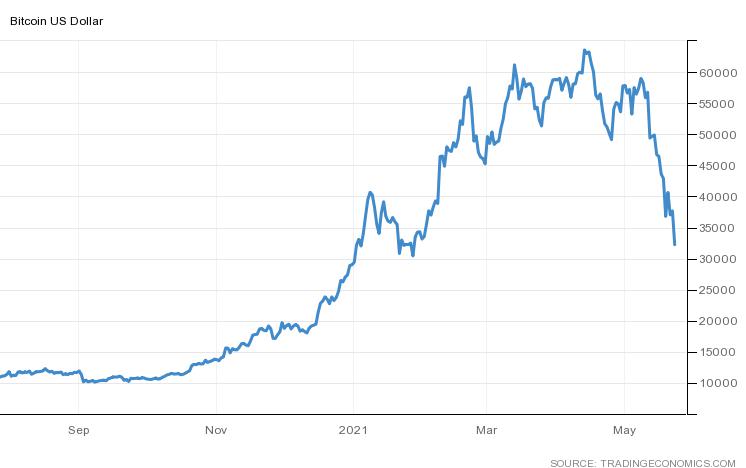

- Crypto is selling off. Is crypto a leading indicator for the overall market direction? Hmm. I think it might be. It’s possible that the Gex X / Yers who thought investing in crypto was fun might tighten their wallets or go to cash. This could fuel the move away from growth and tech stocks.

- Fearing the FED. Even though I don’t think the FED will raise interest rates this year, the topic is starting to freak people out. The rotation out of high-flying tech stocks might just be the beginning.

- FED’s Reverse Repo. Simply put, this is a tool used by the FED to control money supply as well as a way for commercial banks to provide ongoing lending operations. Lately, we’ve seen a huge spike in Reverse Repos (FED selling back securities to the commercial banks) and it may be pointing to a growing concern that the market is flooded with too much cash. Too much liquidity could help drive up inflation. With RRPs, the FEDs balance sheet booms with cash, while simultaneously removing cash (liquidity) from the banks. Are banks showing signs of growing stress under the piles of cash?

- Equities market losing technical strength. Although the next leg up or down hasn’t been determined, the most recent S&P all-time-high showed some signs of weakening under the hood. An easy way to see this is in the RSI divergence. In this VOO chart, you can see the obvious weakening – not to mention that ugly red candle on Friday. My eyes are on SMA50. Anything below that and I’ll be doing some significant cash-building.

As I try to sort through my next moves, it feels wise to start considering short side hedges against air pockets that are likely to occure over the next few months. The first two trade ideas that come to mind are TBT and SH.