What a crazy week. As expected, the jobs report was very strong and the talk of reopening has intensified on positive vaccine news from the White House. It really looks like this economy is ready to run, but will that translate to a booming stock market? I’m not so sure. As I mentioned last week, overly juiced economic growth can force the Fed to raise interest rates and move investors into fixed income.

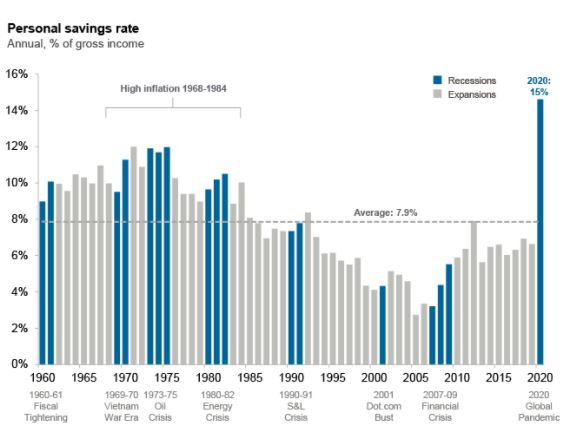

This is a great article from @michaelbatnick that talks about the huge sums of money sitting on the sidelines. Nothing makes the picture more clear than the consumer savings data:

Cathie Wood has a lot to say about recent market activity and it’s not hard to buy into her narrative. Even though her funds have taken a hit recently, it’s important to understand Ark’s strategy and focus on long term trends. If these trends do go as anticipated, her investments will go up huge over the next few years.

Shifting directions, let’s talk about my investments headed into the second week of March. Early last week, I shifted my 401k into cash equivalents to avoid a large drawdown. Keep in mind that I’m approaching 50 and plan to retire around 60. I can’t overly risk large positions and only use smaller accounts in Robinhood, etc. for risk-on trades. Having said that, on Friday, I did shift 30% of my 401k back into US Equity focused positions. I did this because the market did not react negatively to the jobs report and maybe the hyper inflation narrative is a little premature… maybe.

My other accounts haven’t changed significantly since my last update. The ETrade and Robinhood brokerage accounts are heavily in cash, but I’m on the hunt for value and probably will continue to avoid overly speculative growth stocks.

In my M1 Finance passive income account (dividends), I made one minor adjustment. I’ve added an Income ETF from JPMorgan. Why? If we are in fact entering a stock market pause in growth and bond yield are going to continue upwards, I’m going to need some exposure to Income from other sources. Hopefully, JEPI can help. There is a good summary from Michael Gayed who outlines what JEPI is all about.

- JPMorgan Equity Premium Income ETF generates income by investing in domestic large caps and trading in options-based equity-linked notes.

- About 20% of the ETF’s total assets are invested in options strategies which help it hedge if the market corrects dramatically.

- Experienced management and a handsome forward dividend yield of 9% make this ETF an attractive pick for low-risk income investors.

That’s it for now. I’m cautiously optimistic with an eye on quality stocks sold at attractive discounts. If selling gets heavy again, I’ll go back to the sidelines and look for the next fire sale.

Trade ’em Well.