Let’s be honest… anyone who had money in the equities market over the last year did well, and I was no exception. I can attribute the growth to two uniquely 2020 factors: Rising tides lift all boats and being able to work from home.

Here is a snapshot how how I performed (mid January 2020 to mid January 2021).. some good stuff and some not-so-good stuff. Note that in 2020, I didn’t trade on margin or in options.

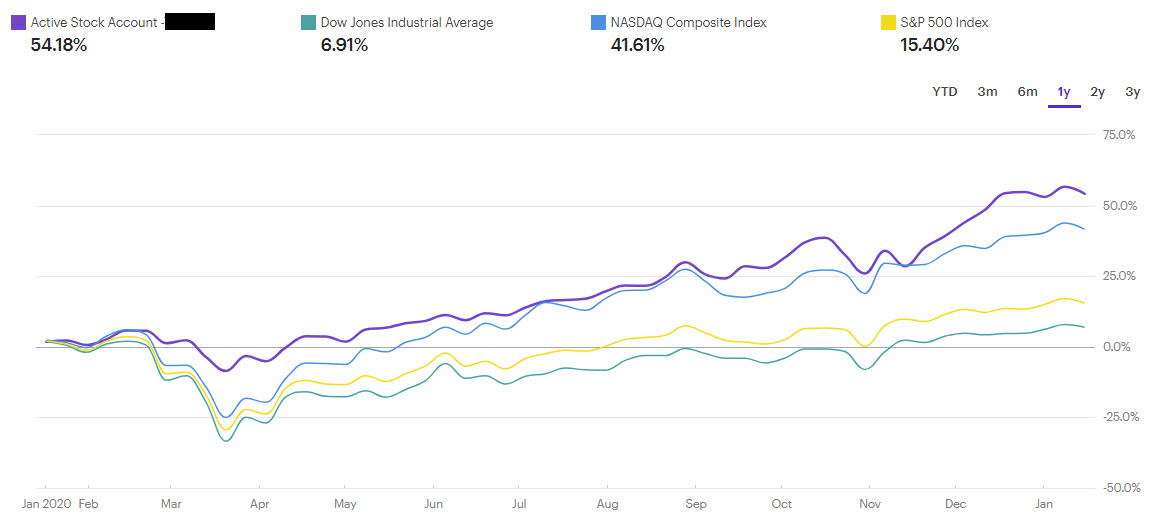

Etrade Brokerage

In this account, I focus on long-term swings and macro trends.

Robinhood

This is a high-risk, speculative trading account where I spend most of my time. In early January, I briefly tapped 100% YoY growth, but have since pulled back to about 83% YoY.

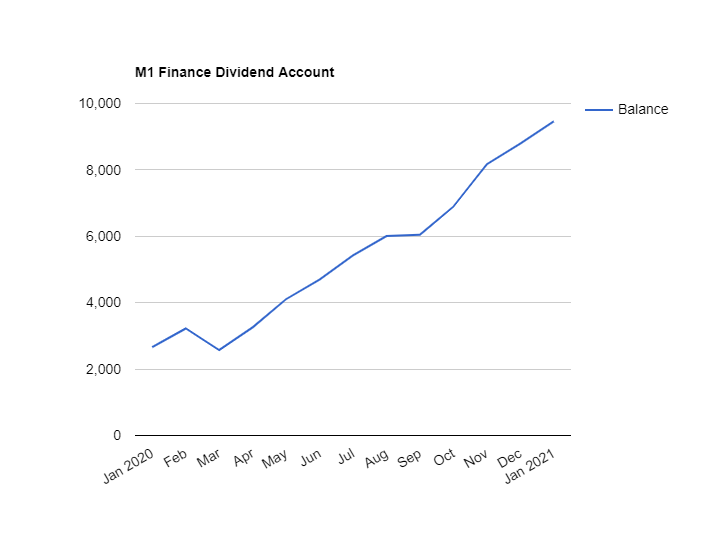

M1 Finance

This is a dividend growth account with little trade activity or risk. I’ll likely get more involved here in 2021 and add some more speculative dividend stocks with higher payouts. As you can see, this account grew a lot, but a good portion of this was due to regular deposits. The growth percentage excluding deposits was about 40%.

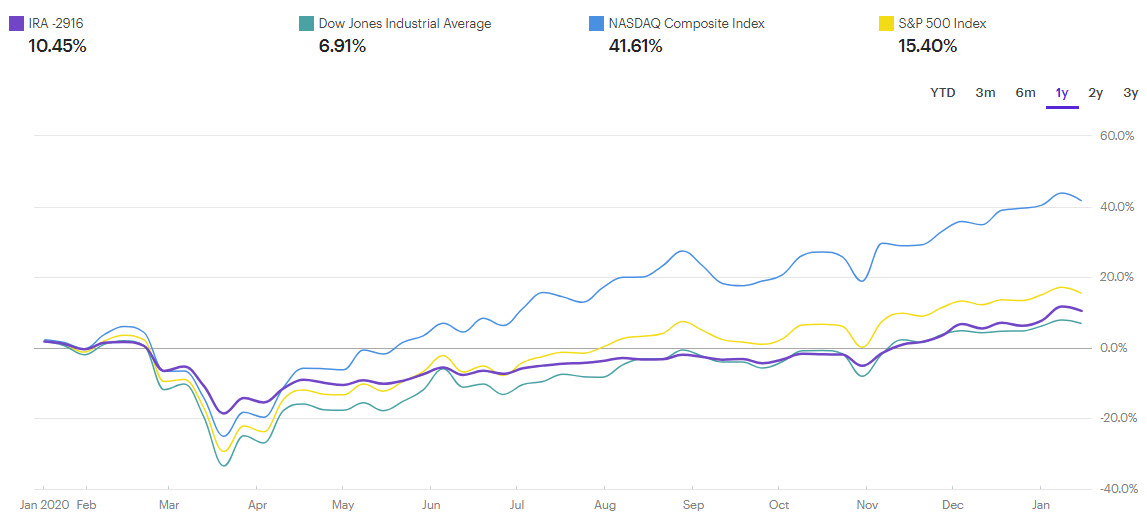

eTrade Roth IRA

This was a real disappointment. I can only blame myself for not managing it closely. That will need to change in 2021. I beat DJI, but that’s not very impressive.

I don’t have a chart to share, but my 401k performed inline with my Roth.. again, poor management on my part although it’s more difficult to beat the market in a 401k since there are few investment options.

I also have small investments in Webull, Fundrise, and Coinbase. Coinbase is getting interesting, however, with the recent move in Bitcoin. I consider anything I put in Crypto as highly speculative and am not counting on it to fund my retirement. I think it needs to be less volatile and thought of as a currency and less of a hedge against the market. We’ll see what the market holds there.

On to 2021!

Trade ’em Well.