Last week’s rotation out of big tech was something new, but was it just profit taking ahead of the next leg up or was it a true rotation? The beneficiary, gold, implies traders were a little uneasy and seeking to secure profits and move to safety. We’ve gotta get some clarity surrounding the details of the second stimulus bill. We also need the Covid-19 numbers to improve and improve soon. Friday’s Covid-19 data implied we MIGHT be peaking. This alone might help the market open up on Monday.

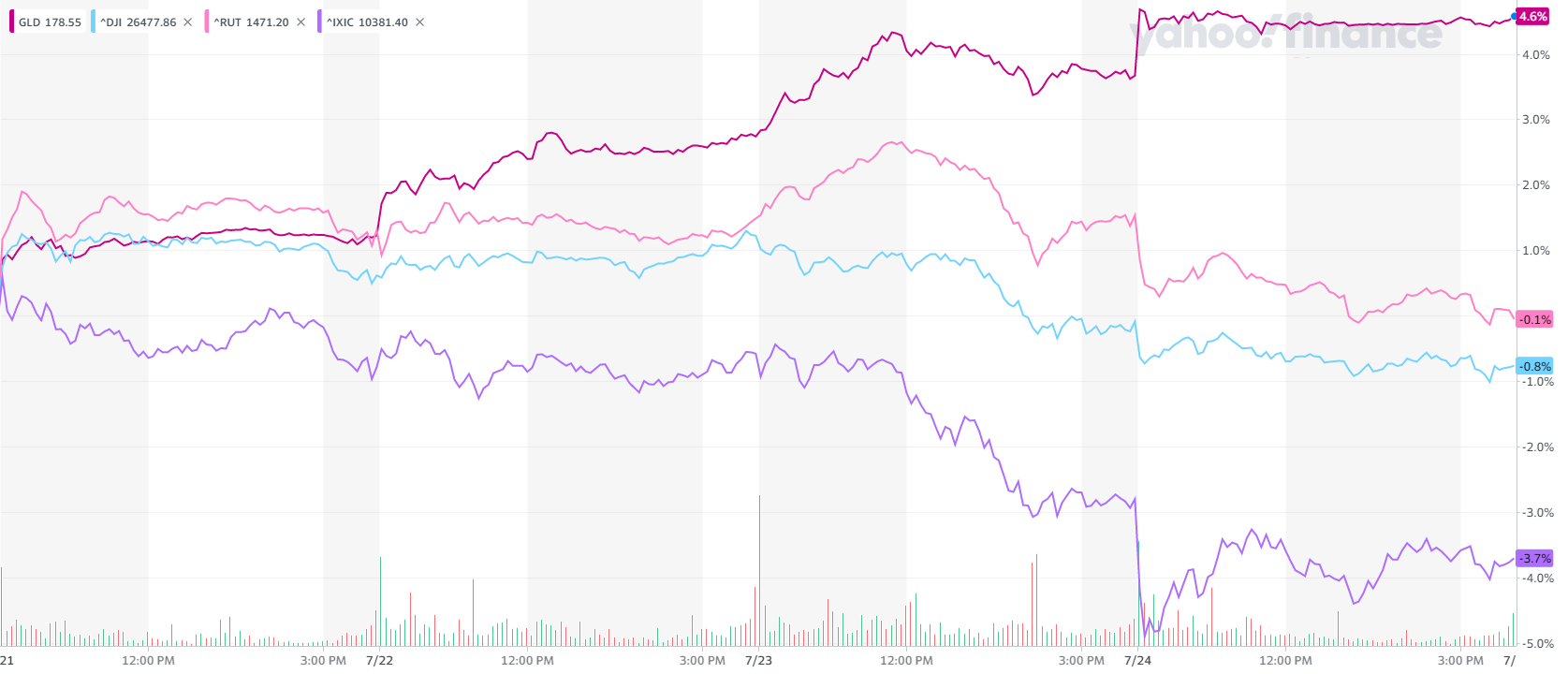

Nasdaq lost 3.7% last week, while GLD gained 4.6%. I hold a good amount of gold in my IRA as a hedge against market momentum rotation just like we encountered last week.

5 Day GLD vs Market

This week will be all about earnings, Covid-19, and stimulus money.

#earnings for the week https://t.co/lObOE0dgsr $AMZN $AAPL $AMD $FB $SHOP $BA $PFE $MCD $UPS $MMM $PYPL $HAS $GE $SPOT $V $APHA $EBAY $MA $SBUX $RTX $AZN $F $SAP $QCOM $CNC $MO $XOM $PG $ABBV $GOOG $TDOC $RPM $GILD $NOW $KHC $DXCM $ABCB $BUD $JBLU $CLF $PINS $ANTM $WING $LRCX pic.twitter.com/6uIxQZedzN

— Earnings Whispers (@eWhispers) July 25, 2020

So, am I buying? Likely. The weekend Covid-19 numbers were encouraging and our ridiculous government will be forced to help the general public with an injection of stimulus in the way of checks and forgiveness of pretty much everything.

Few stocks I’m watching (swing long):

SGMS over 17.70

DKNG over 38.20

Electric companies for reduced risk/dividend rotation:

NRG over 34.5

CIEN over 57

DPZ holding MA50

AMRS over 4.30

Strong up trends on pullbacks

FCEL on SMA50

DOCU on EMA23 – concerned here, but EMA23 has been historical support

REGN on EMA23

MRNA on EMA23

PODD i like adding after long lower shadow candles

IRTC if it regains Thursday’s highs

WORK is interesting that it tapped and help EMA23

BIDU might be a long add here

BYND interesting at EMA200 hold

CRWD on SMA50 – I like this sector in general

EVBG on pullback.. adding above SMA50