There are stocks that just know how to run… and run for a long time. As traders, these are the easiest to recognize, but we still waste time scanning for other trades. Maybe there is something deep inside of us that wants to catch a move early and before everyone else – the contentment of discovery. However, I argue that although boring, finding stocks in an uptrend is the easiest train to catch.

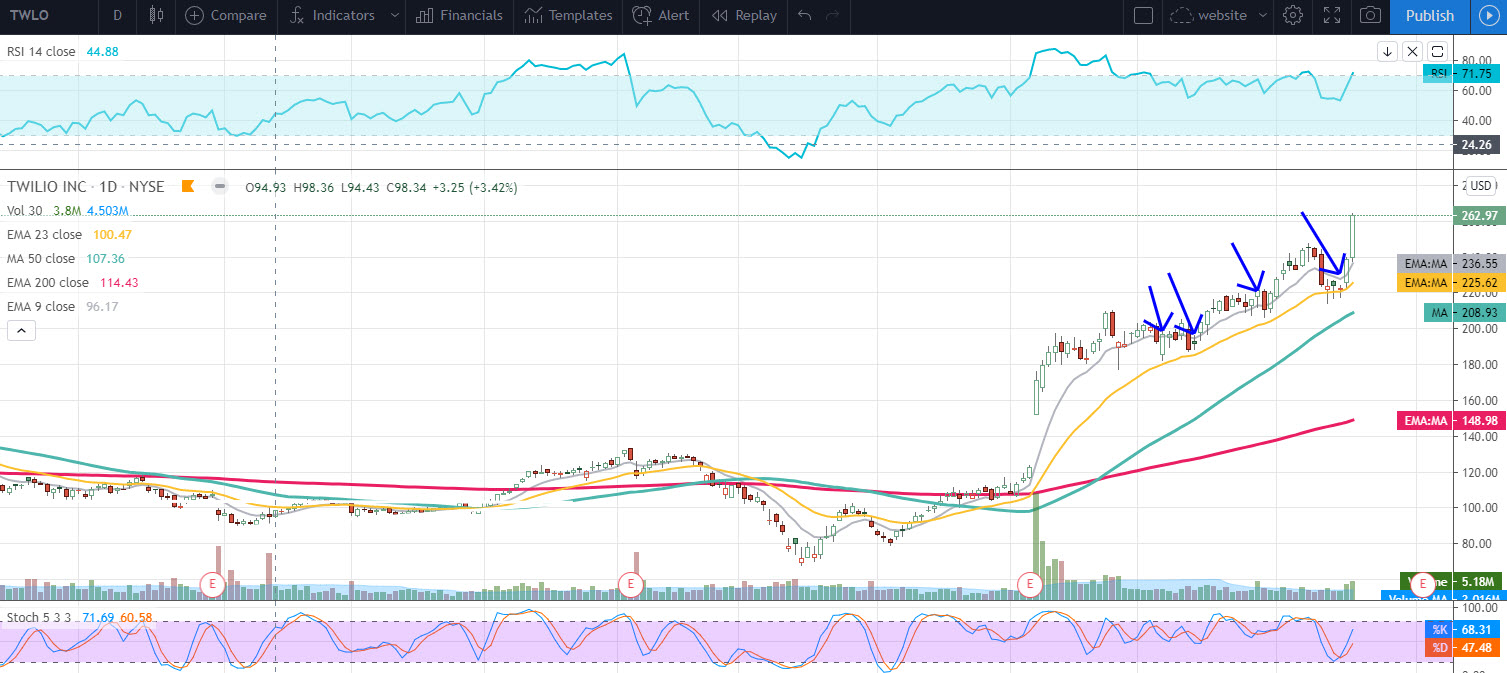

My favorite stocks-on-the-run setup is to participate in moves that bounce off EMA23. Once I see a pattern of EMA23 support (EMA23 acting as a pivot), I simple move in on the day after the bounce if price continues its bullish direction. The other variable – I wait for EMEA9 to convincingly move above EMA23. Ideally, EMA9 is running in a somewhat parallel direction with EMA23. This is a technically strong trend.

I exit my position only if the stock closes 2 days consecutively below EMA23.

Here are a few examples of stocks currently in strong trends that could have been entered months ago.

EMA23 yellow/orange

EMA9 grey

PTON

TWLO

Others include SPOT, PING, TWOU, FVRR, OSTK, ZM, SHOP, AMZN, ZEN, NOW, SQ, WDAY, ZS, AYX, TTD, EPAM . The list goes on and on.

You get the idea. Keep it simple – ride the wave.