China Trade Winds

Xi and Trump continue to shuffle the mirrors and blow the smoke. The duo is even marketing the trade deal as something bigger – now it’s also about world peace and other non-measurable crap. Whatever. The market seemed to wake up to this just before the close on Friday and the excitement quickly faded. Too many questions causing too much pain.

Market Impact: Instability

Don’t fight the Fed

Most of the attention last week was on China, but we can’t ignore the recent actions out of the Fed. They can call it what they want, but the liquidity is what matters. It’s usually a really bad idea to fight the Fed and they appear to be interested in trying to minimize market pullbacks through quantitative easing. This is a positive for equities investors.

Market Impact: Positive

Fed Interest Rates

With the global market slowing, it’s likely we’ll continue to see lower interest rates.

Market Impact: Positive, but limited

Consumer Sentiment

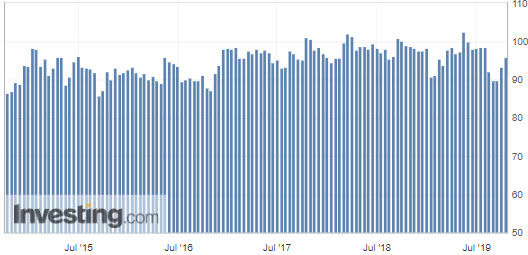

Consumer Sentiment numbers were higher on Friday, to my surprise, which helped contributed to the early market moves. The longer the data shows consumer strength, the more i doubt the data. It will start coming down and when it does, the market will roll over. Soon? Who knows.

Michigan Consumer Sentiment

Market Impact: Positive

Technical View

SPY is still in an uptrend. Ignore all the other noise. In a closer time frame, SPY is starting to consolidate into a triangle – this is important. At some point, we’ll get a breakout above or below. I’ll go heavy either way. Until now, I’m staying careful around earnings and news.

SPY Daily