I don’t like it.

The market just doesn’t feel right. Sure, the equities market is printing easy money and I would be ludicrous to complain. But, I just don’t see this strength lasting through the back half of the year. Inflation will be the likely headwind lead by housing costs, fuel, healthcare, and food.

For this week, I don’t see an edge one way or the other. If anything, we may see a slip in market strength as traders absorb the latest tariffs from Trump.

SPY’s under-the-hood-strength has slightly weakened and a pullback to EMA23 seems likely and healthy.

SPY Daily

IWM still looks good and is less influenced by tariffs.

IWM Daily

Most notable change in the market on Friday was the increased strength in old-school blue chip stocks. These have been largely ignored because of the insane strength in tech stocks. But, Friday’s rotation is possibly significant. We haven’t seen this kind of move into dividend plays for many months.

PG Daily

KHC Daily

Few Long Setups to Consider

ANET, ALXN, TXN, NKE, NOW, WM, ACN, CRUS, CGC, HRL, WTR, GLW, ILG, RCM, CSCO

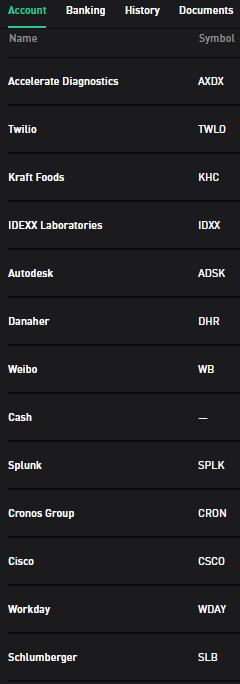

Current Short Term Trading Account Positions (50% cash)

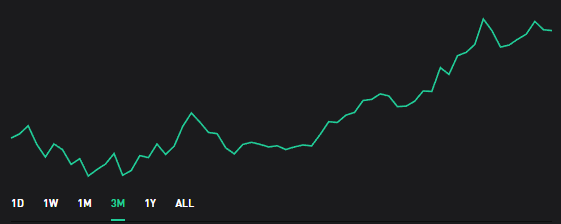

3 month return 5.07%

Good Reading from Steve Burns

10 Great Technical Trading Rules – https://t.co/8yfezzXKg8 awesome read by @SJosephBurns $STUDY

— Ryan (@ryanmathews) June 16, 2018